As demand for housing drives up prices, more houses have sold in Rutherford County for a million dollars or more than ever before. In January, there were 26 homes for sale for over a million dollars. The most expensive being Five Peppers Farm that is listed for $9.3 million. Ten years ago, the average price for a home in the United States was $210,000, and according to thetruthaboutmortgage.com that number has increased to more than $320,000.

“In 2022, house prices are set to rise by 11% in the United States,” said Kurt Walker, CEO of Cream City Home Buyers in an article on gobankingrates.com. “This is still a step down from the previous year’s price hike of 19.5%. However, predominantly the market will still advantage sellers over buyers. The market will remain competitive, with home sales predicted to increase another 6.6%.”

According to market comparisons of 2019 to 2021 provided by Middle Tennessee Association of Realtors and John Jones Real Estate, housing prices in Rutherford County have increased by %124 percent. The average listing price in 2019 was $370,875, and in 2021 it was $830,175.

Both the average and median days on the market have fallen by 66.67%, with the median number of days on the market falling to three in 2021. Some homes have sold in a matter of hours with multiple offers driving up the price; having 20 offers or more is not unusual in the current seller’s market according to nashvillehome.guru.

The supply of homes decreased by 20.98 % between 2019 and 2021. Multiple factors are involved in the lack of inventory, but Millennials jumping into the housing market and lag in home building that started in 2008 during the great recession are significant factors.

Forbes.com reports that Millennials “make up the fastest-growing segment of buyers today, according to a recent National Association of Realtors report. Particularly, those in their late 20s to early 30s are pushing this segment along the most.”

Andrew Iremonger, who runs a real estate team called the Emerald Group at eXp Realty in an article on gobankingrates.com agrees.“Right now, we have a supply-and-demand issue for the foreseeable future. Pending World War III or something catastrophic that we can’t account for, the prices will continue to rise because of it. The reason being: We have the largest buying force in history entering the first-time homebuyer space — the Millennials. The average first-time homebuyer is around 34 years old in this country right now and the average Millennial is around 35 years old — so here is our demand.”

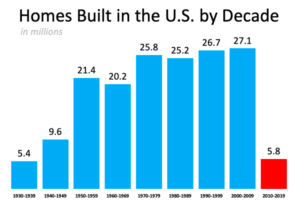

The other major factor is that the number of homes being built has been at a low rate since 2008-2009. While at that time there was a problem of surplus homes, in the last ten years homes have been built at a rate not seen since the 1930s during the Great Depression. There has been a deficit of homes for some time, but the lag in homebuilding caught up with demand during the pandemic.

“Our supply is low because of builder demand,” Iremonger said in the gobankingrates.com article. “Over the last 12 years, builders have been far below the average in the amount of homes they are building…2021 and 2022 are the first two years where they have been close to the amount of new builds that we have needed in the last 12 years….”

Building rates are currently being affected by supply chain issues which continue to plague the construction industry, partly caused by the pull back in manufacturing during the global quarantine, partly by the lack of workers willing to come back into the job market in order to increase production, and partly by new tariffs placed on raw materials from other countries – like Canada which supplies this country with much of its lumber.

Still, for 2022, in spite of all that is happening in the market, home sales are expected to continue to grow, if at a slower rate. Housing prices will continue to rise. And those looking for a home and those helping buyers with that search will continue to work in a tight market. However, builders are continuing to put up new homes as fast as possible working through supply delays.

Those who are selling their homes will continue to get top dollar, although forecasters see some stabilization of the market beginning in 2022 as the pandemic eases.