It is no secret that property values in and around Nashville have skyrocketed in the last decade. Since the “Great Recession” of 2007-2011 real estate has increased in value beyond belief.

There are many reasons for this recovery and expansion of market values. Any one of these reasons in and of itself may cause only a ripple in the real estate market. This “perfect storm” of all of these reasons, in convergence, has created a market the likes we may never see again.

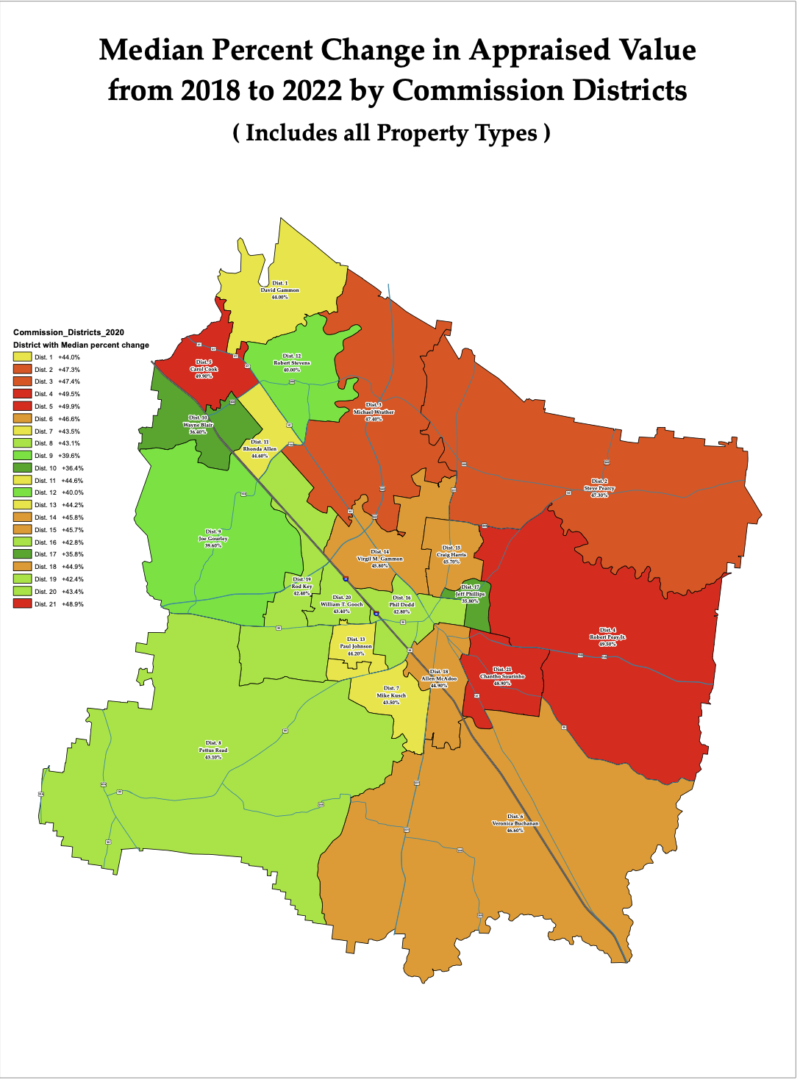

Property Assessors are charged by the Constitution and statutes of Tennessee to bring all property to market value for property taxation purposes no less frequently than once every six years. In faster-growing counties, shorter periods of five or four years may be selected to prevent large jumps between cycles such as the “heat map” below illustrates. Rutherford County revalues and equalizes on a four-year cycle.

The median increase in values between 2018 and 2022 for Rutherford County Tennessee is what. It’s believed to be a state record, of 44%!

Below is the exact median percent change for each district:

- District 1 +44%

- District 2 +47.3%

- District 3 +47.4%

- District 4 +49.5%

- District 5 +49.9%

- District 6 +46.6%

- District 7 +43.5%

- District 8 +43.1%

- District 9 +39.6%

- District 10 +36.4%

- District 11 +44.6%

- District 12 +40.0%

- District 13 +44.2%

- District 14 +45.8%

- District 15 +45.7%

- District 16 +42.8%

- District 17 +35.8%

- District 18 +44.9%

- District 19 +42.4%

- District 20 +43.4%

- District 21 +48.9%

What this means is that when the cities and counties in Rutherford County calculate a revenue-neutral tax rate for their jurisdictions; they will record low values as well. Citizens should understand that these rates will produce revenue numbers from the tax base which are equivalent to the previous year’s tax levy. The tax burden is redistributed based upon the demand in the market for property types.

What this means is that when the cities and counties in Rutherford County calculate a revenue-neutral tax rate for their jurisdictions; they will record low values as well. Citizens should understand that these rates will produce revenue numbers from the tax base which are equivalent to the previous year’s tax levy. The tax burden is redistributed based upon the demand in the market for property types.

Should your local taxing authority (your city, town, or county government) exceed this revenue-neutral tax rate then it is a tax increase that is being adopted. The Tennessee Comptroller of the Treasury has created a wonderful video that describes this process very well.